Project

Advisory

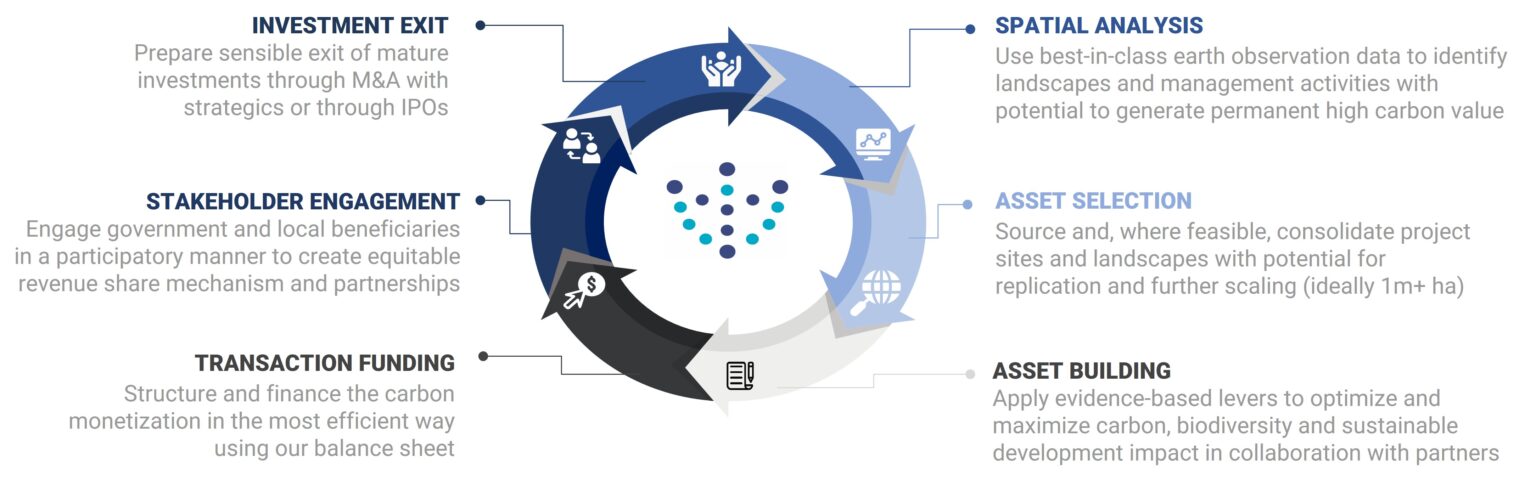

We originate NbS carbon supply at sites of high conservation and climate mitigation value. We structure NbS carbon projects with the best risk- return-impact profile in collaboration with leading industry partners. We manage carbon assets for investors along the entire project cycle and structure an ideal exit route.

Under-

writing

We underwrite high-integrity carbon projects (and high- integrity carbon project developers) with our balance sheet. We provide carbon project access to strategic investors through debt and equity syndication. We structure institutional funding solutions with tested risk mitigation strategies.

Financial placement

We place high-integrity carbon credits via advanced purchase commitments with select Tier 1 offtake partners in our network. We monetize the underwritten carbon in a fair, transparent, and equitable way ensuring appropriate community and host country benefaction in line with leading best industry practice.